From strategy to production

Agency for sustainability reporting

Preparing a sustainability report calls for considerable financial and human resources within the company. To use these resources as effectively as possible, it makes sense to take a strong partner on board. As an agency for sustainability communication, we are proficient in the individual steps involved in producing a sustainability report and will accompany you throughout the process.

Step 1

Defining a strategy and vision

From a necessity to a strategic advantage

A sustainability strategy should be in place before a sustainability report.

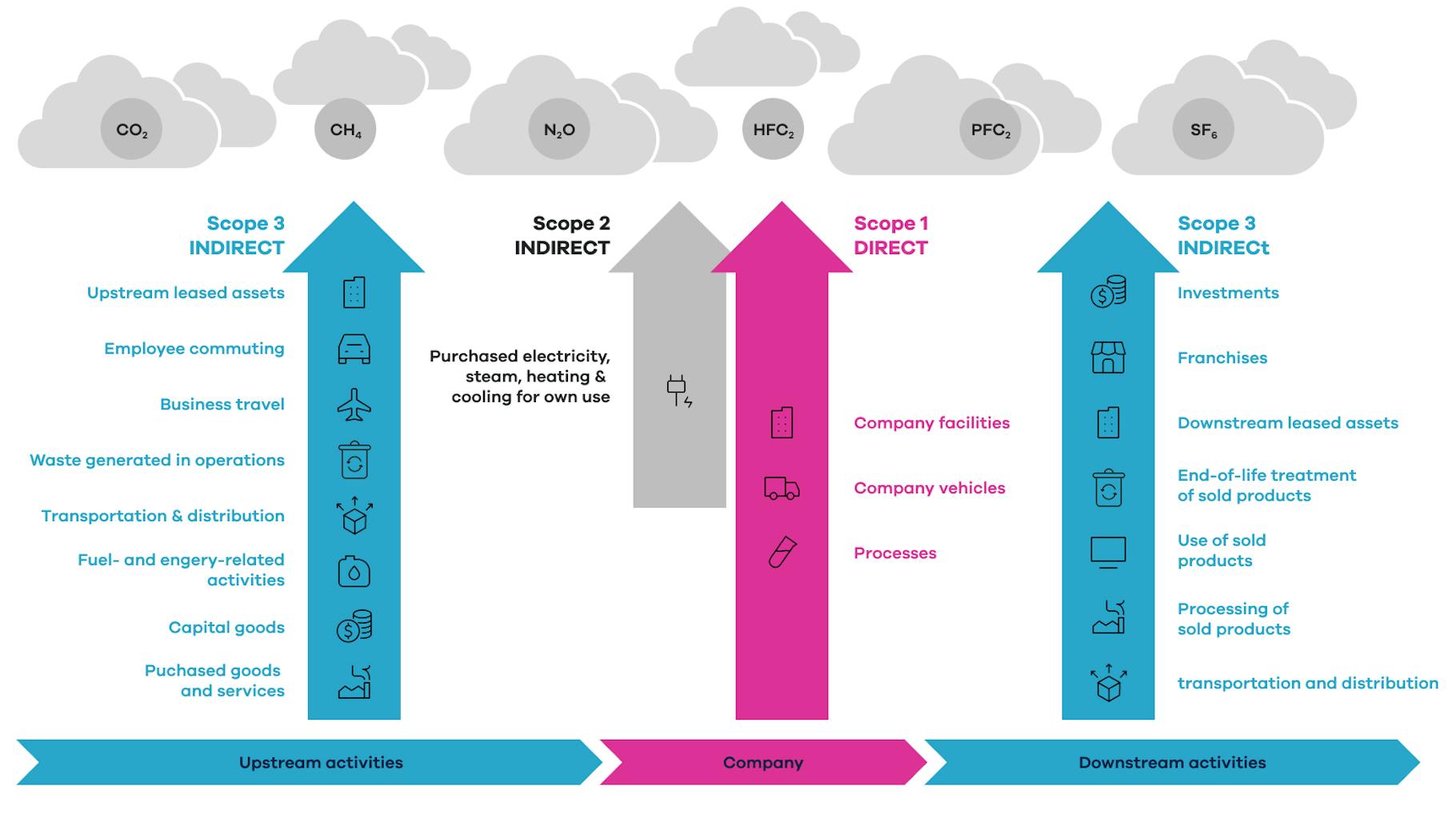

Sustainability is no longer just nice to have, it has become decisive for a company’s economic success and competitiveness. This is increasingly forcing companies to align their activities towards a sustainable transformation and to keep an eye on the entire value chain. The due diligence obligations apply to the upstream and downstream supply chain.

As a consulting agency for sustainability, we understand the challenges and will be happy to support you on your journey to becoming a sustainable company.

There are many guidelines and laws intended to facilitate this transformation to a sustainable economy. As a result, however, there is an increasing lack of orientation in the at times overwhelming jungle of available methods and approaches.

This also applies to sustainability reporting. As an agency for sustainability reports, we will show you how best to proceed and support you in reaching your goal!

Source: myclimate

Step 2

Understanding the legal framework

CSR becomes CSRD: The reporting obligation regarding sustainability is expanding

Until now, the requirements of the CSR Directive Implementation Act (CSR-RUG) on non-financial information of 2017 applied to 500 large capital market-oriented companies in the German region. However, the number of companies in Germany subject to reporting requirements is estimated to increase thirty-fold as a result of the new CSR Directive “Corporate Sustainability Reporting Directive”. This is because small and medium-sized companies with a capital market orientation are now also subject to the reporting obligation.

All companies in the EU will be obliged to report if they meet at least two of the following three criteria:

- A balance sheet total of more than 20 million

- A net turnover of more than 40 million

- Or more than 250 employees.

If your company meets two of these three criteria, you will have to submit a sustainability report in compliance with the new Corporate Sustainability Reporting Directive (CSRD) as of 2026 at the latest.

Reporting companies should also keep these EU regulations in mind:

- The EU Taxonomy Regulation makes sustainability a financial indicator.

- EU CS triple D (CSDDD) follows the German Supply Chain Sourcing Obligations Act.

- The EU Green Claims Directive includes criteria against misleading environmental claims.

Corporate Social Responsibility Directive (CSRD) – Sustainability reports become comparable

With the increasing volume of sustainability information, customers, employees, investors and civil society are demanding a way to put this information into a comparable context.

The new CSR Directive (CSRD) aims to make sustainability information comparable at the European level. This entails a profound change in the requirements for non-financial reporting as well as an increase in the accountability of companies on ESG issues.

Sustainability reporting in accordance with CSRD will be implemented in the EU as of the 2024 financial year. Initially, it will only apply to a limited group of companies, which will be successively expanded.

Step-by-step implementation:

- As of 2024, public interest entities with more than 500 employees will be affected.

- As of 2025, all other large companies and groups that fulfil two of the three criteria (more than 250 employees, turnover of more than 40 million euros and a balance sheet total of more than 20 million euros) will follow.

- From 2026 onwards, all capital-market-oriented small and medium-sized companies that meet two of the three criteria (more than 250 employees, turnover of more than EUR 40 million and total assets of more than EUR 20 million) must also submit a sustainability report in accordance with CSRD.

CSRD reporting is carried out in accordance with the uniform European Sustainability Reporting Standards (ESRS).

EU Taxonomy – Sustainability performance as a financial indicator

Sustainability has become a fundamental indicator for risk assessment and is therefore also relevant from an investor’s point of view and in terms of lending. The legislator is driving this development with the new EU taxonomy.

The EU taxonomy is a set of rules for classifying sustainability in investment decisions. It aims to steer capital flows into environmentally sustainable economic activities. Economic activities are classified according to their sustainable character and the degree of sustainability of an investment is determined. For companies, this means reporting on the extent to which investment and operating expenses as well as sales revenues contribute to sustainable economic performance.

The assessment of economic activities is based on three criteria. An economic activity is considered sustainable if it makes a significant contribution to the implementation of at least one environmental goal (1) without significantly compromising the achievement of another environmental goal (2) and if it complies with minimum social standards (3).

The EU taxonomy’s six environmental goals

- Mitigation of climate change

- Adaptation to climate change

- Sustainable use of water resources

- Transition to a circular economy

- Pollution prevention

- Protecting ecosystems and biodiversity

Who does the EU taxonomy apply to?

All public interest companies with more than 500 employees. All companies subject to CSRD. The prerequisite for this is the fulfilment of two of the three criteria: more than 250 employees, turnover of more than 40 million euros and a balance sheet total of more than 20 million euros.

What needs to be done?

- Identification of taxonomy-compliant economic activities: An economic activity is deemed taxonomy-compliant if it can be assigned to one of the three taxonomy criteria.

- Verification of taxonomy compliance: An economic activity is deemed taxonomy-compliant if it also fulfils the criteria, i.e. makes a significant contribution to the implementation of an environmental objective without compromising the achievement of one of the other environmental objectives, while complying with minimum social standards.

CS triple D – Keeping an eye on the entire supply chain

In a globally networked economy, it is increasingly challenging for companies to keep track of the entire environmental impact within a product life cycle. However, stakeholders and regulatory developments demand transparency along the entire supply chain.

The CS triple D (CSDDD) follows the German Supply Chain Due Diligence Act. The EU directive requires companies to conduct due diligence with regard to human rights violations and environmental damage along global value chains.

Specifically, the CSDDD requires companies to identify, mitigate and stop negative and potentially negative impacts on the environment and human rights in their own operations, in subsidiaries and along the entire value chain. The directive also includes civil liability, according to which injured parties must be compensated accordingly.

Who does the CS triple D apply to?

- Group one: EU companies with more than 500 employees and a worldwide net turnover of more than €150 million.

- Group two: EU companies with more than 250 employees and a worldwide net turnover of more than €40 million, provided that at least 50% of this turnover was generated in a high-impact sector.

- Group three: Non-EU companies with a net turnover in the EU of more than €150 million in the last financial year.

- Group four: Non-EU companies with a net turnover in the EU of more than €40 million, provided that at least 50% of the global turnover was generated in a high-impact sector.

- Companies that fall into group one or three must ensure that their business strategy is compatible with limiting global warming to 1.5 °C and therefore with the Paris Agreement.

What needs to be done?

- Due diligence needs to become a key part of company policy.

- Identify and reduce or prevent negative and potentially negative impacts on human rights or the environment.

- Establish complaints procedures.

EU Green Claims Directive:

The EU Green Claims Directive addresses misleading green claims and environmental labels. In the future, companies will have to provide evidence for voluntary advertising claims about environmental aspects of products or services. Statements that are protected by existing EU regulations are exempt.

The directive also targets labels that refer to the environmental impact of products. The aim is to combat the proliferation of public and private eco-labels.

Who does the EU Green Claims Directive apply to:

The directive applies to all companies in the EU. Companies with fewer than ten employees and a turnover of less than €2 million are exempt.

What needs to be done:

- Statements and claims already made that are not covered by existing EU regulations, such as the EU Ecolabel or EU organic logo, must be checked for accuracy and substantiation.

- The EU Member States are setting up verification systems according to which companies will have to align their claims in the future.

STEP 3

Identifying key issues and stakeholders

Identifying key issues and stakeholders

To make sustainability reports comparable, companies need to report on similar topics. Therefore, the identification of the topics to be reported is carried out according to a uniform scheme referred to as “double materiality”.

For a topic to be considered “material”, it must either have an impact on people and the environment (impact materiality) or on the development of the company (financial materiality).

Impact materiality (inside-out perspective)

Financial materiality (outside-in perspective)

The stakeholder survey

The exchange process with stakeholders is about understanding and buy-in.

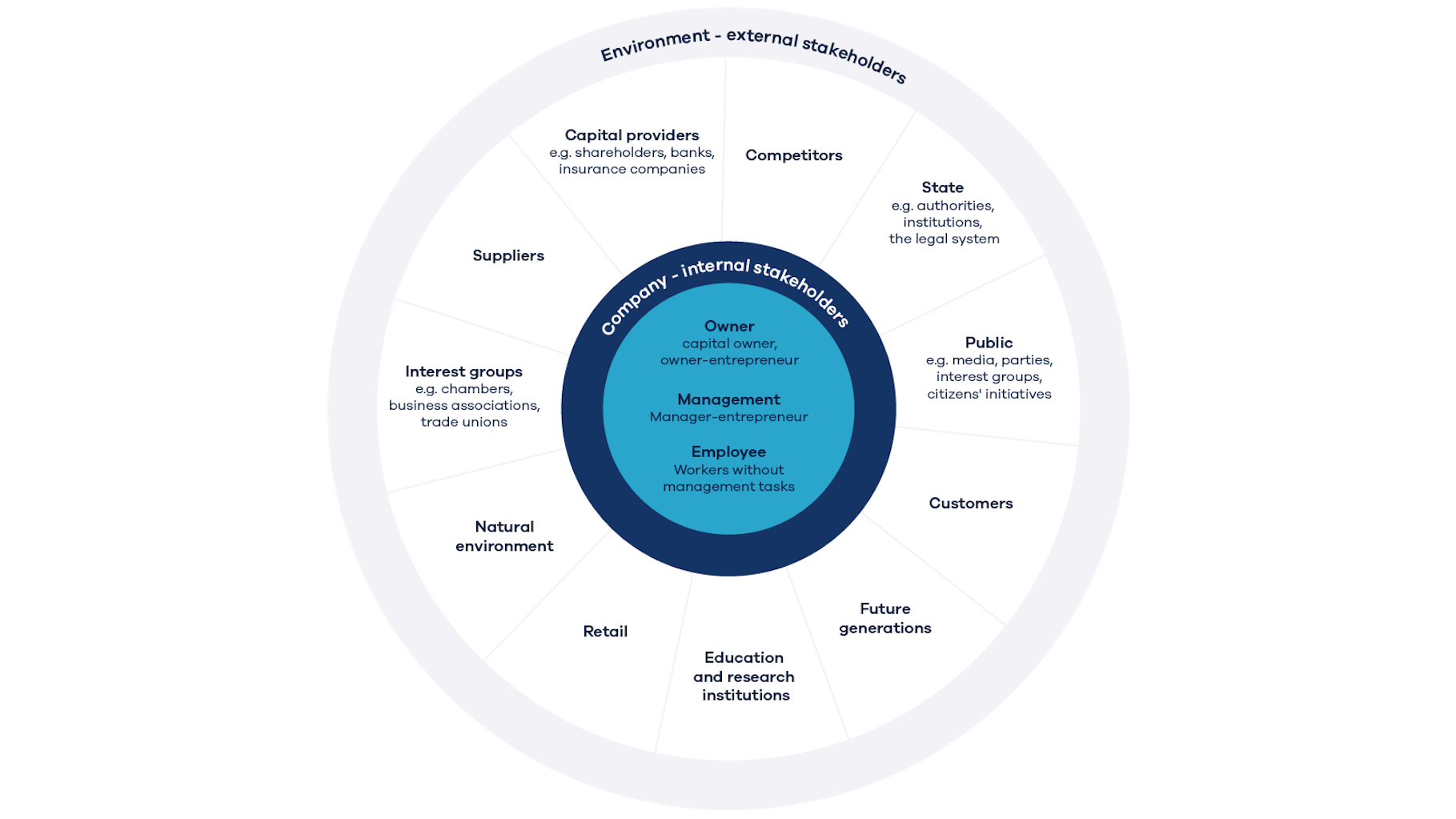

A materiality analysis should not only be developed from the company’s point of view, it should also include the interests and opinions of the stakeholders. After all, stakeholders are partners with legitimate demands and individual interests in terms of sustainability. To adequately take these interests into account, companies need to enter into a dialogue with their stakeholders based on trust, partnership and long-term collaboration. A stakeholder survey has proven to be a best practice.

Source: Grundwald/Schwill 2017a, p.44; also see Grundwald/Schwill 2017b, p.933f. and Hügens/Zelewski 2006, p.372)

At the end of a materiality analysis, a materiality matrix is drawn up, taking into account double materiality, stakeholder surveys and the prioritisation of corresponding CSR fields of action. Source: German Sustainability Code

Step 4

Collecting data on material topics

Collect data on material topics

The topics to be reported in the sustainability report are defined on the one hand by the materiality analysis and on the other, by the requirements of current governance. When collecting data, it has to be clear which information needs to be provided according to the current reporting standards (European Sustainability Reporting Standards).

Data collection is one of the more complex steps in the sustainability report. Intelligent data systems that can generate the required KPIs at the push of a button are of course an advantage. In addition to pure figures, however, qualitative results from surveys or interviews are also of interest.

Requirements for indicators:

- Timeliness and continuity (uniform determination methods, regular review)

- Completeness and representation (consideration of possible outliers, sufficient sample size)

- Validity

- Accuracy

- Reproducibility

- Comprehensibility

- Comparability

- Influenceability

From a single source: software-supported sustainability management with leadity

Step 5

Deriving specific measures and key figures

Deriving specific measures and key figures

Using the data collected on the basis of the materiality analysis, sustainable corporate goals can be set, which are made measurable through suitable key performance indicators (KPIs). From this, concrete measures can be derived within the CSR fields of action. The transformation towards sustainability begins.

Possible CSR fields of action:

Employees

Market

Environment

Society

Corporate governance

Making impact measurable:

The next step in the implementation of sustainability activities is to monitor them through the development of key performance indicators. Measuring and monitoring key performance indicators can contribute to ensuring that the measures are paying off against the intended goals and are therefore driving the desired sustainable transformation.

Step 6

Writing the sustainability report in accordance with current standards

The sustainability report following current European Sustainability Reporting Standards

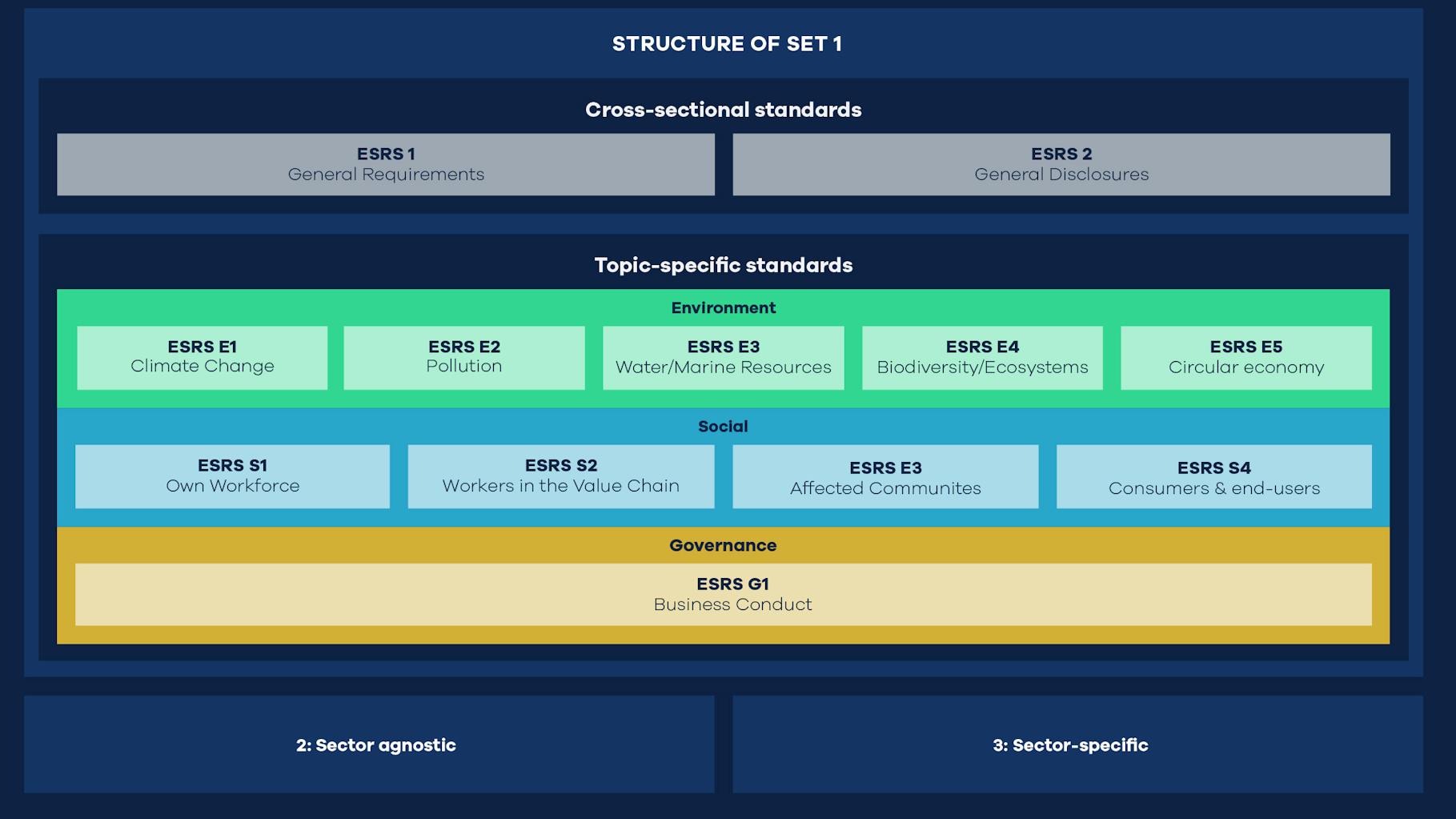

The European Sustainability Reporting Standards (ESRS) are the result of the new CSRD at the reporting level. They replace the previously valid reporting standards based on the Global Reporting Initiative (GRI). The ESRS oblige companies to incorporate the sustainability report into the management report. The mandatory report audit is carried out in accordance with ISAE 3000 or a similar standard.

The European Sustainability Reporting Standards (ESRS) are developed in phases in three sets:

The topics from Set 1 are mandatory reporting for all companies affected by the new CSRD. The set consists of twelve reporting standards. Ten of these standards target sustainability topics from the three pillars of environment, social affairs and governance. Two overarching standards include application rules and generic requirements.

The specific content of Set 2 is expected to be defined by the end of 2023. Sector-specific reporting standards and simplified reporting standards for listed small and medium-sized enterprises are expected. Set 3 will extend the sector-specific reporting standards to further sectors.

Source: Deutsches Rechnungslegungs Standards Committee e.V.

Source: EFRAG

And finally: the sustainability report

There are many ways to present the sustainability report.

In addition to the classic report, a company blog or web magazine are also suitable. Both formats are characterised by their dynamic nature and grow with the website, which ensures ongoing relevance.

Publishing the corporate sustainability report in a blog or web magazine increases visibility and draws the attention of potential customers, investors or partners to the company’s sustainability efforts. Moreover, such a format provides a platform for sharing knowledge and experiences.

No matter which format is best for you, we as an agency for sustainability reporting will gladly implement it with you.

Further areas of expertise in our team:

Your contact

20 years of experience in sustainability issues. Sustainability reports, including GRI and DNK, brochures, sustainability websites, films and video streams, moderation. Expertise in mechanical and plant engineering, food, tourism and other industries.